COLORADO DEPARTMENT OF LABOR AND EMPLOYMENT

Division of Labor Standards and Statistics

Colorado Overtime and Minimum Pay Standards Order (COMPS Order) #36

7 CCR 1103-1 (2020)

Adopted on January 22, 2020. Effective March 16, 2020.

Rule 1. Authority and Definitions.

-

1.1 Authority and relation to prior orders. Colorado Overtime and Minimum Pay Standards Order (“COMPS Order”) #36 replaces Colorado Minimum Wage Order #35 (2019), and all prior Minimum Wage Orders. It renames the regularly-issued “Minimum Wage Order” to reflect that this order covers not only minimum wages, but also overtime and other related wage and hour standards. The COMPS Order is issued under the authority of, and as enforcement of, Colorado Revised Statutes (“C.R.S.”) Title 8, Articles 1, 4, and 6 (2020), and is intended to be consistent with the requirements of the State Administrative Procedures Act, C.R.S. § 24-4-101, et seq. See Appendix A for citations. The effective date of COMPS Order # 36 is March 16, 2020.

-

1.2 Incorporation by reference. The Fair Labor Standards Act, 29 U.S.C. §§ 201 et seq.; 20 C.F.R. §§ 655.210, 655.1304; 29 C.F.R. Part 541 Subpart G; Colo. Const. art. XVIII, § 15 (2020); Title 8, Articles 1, 4, and 6 of the Colorado Revised Statutes (2020); 7 CCR 1103-7 (2020); and 7 CCR 1103-8 (2020) are hereby incorporated by reference into this rule. Such incorporation excludes later amendments to or editions of the constitution, statutes, and rules; all cited laws are incorporated in the forms that are in effect as of the effective date of this COMPS Order. All sources cited or incorporated by reference are available for public inspection at the Colorado Department of Labor and Employment, Division of Labor Standards & Statistics, 633 17th Street, Suite 600, Denver CO 80202. Copies may be obtained from the Division of Labor Standards & Statistics at a reasonable charge. They can be accessed electronically from the website of the Colorado Secretary of State. Pursuant to C.R.S. § 24-4-103(12.5)(b), the agency shall provide certified copies of them at cost upon request or shall provide the requestor with information on how to obtain a certified copy of the material incorporated by reference from the agency originally issuing them.

-

1.3 “Director” means the Director of the Division of Labor Standards and Statistics.

-

1.4 “Division” means the Division of Labor Standards and Statistics in the Colorado Department of Labor and Employment.

-

1.5 “Employee,” as defined by C.R.S. § 8-4-101(5), means any person, including a migratory laborer, performing labor or services for the benefit of an employer. For the purpose of the COMPS Order, relevant factors in determining whether a person is an employee include the degree of control the employer may or does exercise over the person and the degree to which the person performs work that is the primary work of the employer; except that an individual primarily free from control and direction in the performance of the service, both under his or her contract for the performance of service and in fact, and who is customarily engaged in an independent trade, occupation, profession, or business related to the service performed is not an “employee”.1

1 The Rule 1.5 definition of employee parallels the statutory amendment to the “employee” definition enacted by Colorado 2019 House Bill (H.B.) 19-1267, effective January 1, 2020.

1.6 “Employer,” as defined by C.R.S. § 8-4-101(6), has the same meaning as in the federal Fair Labor Standards Act at 29 U.S.C. § 203 (d), and includes a foreign labor contractor and a migratory field labor contractor or crew leader; except that the provisions of the COMPS Order do

not apply to the state or its agencies or entities, counties, cities and counties, municipal corporations, quasi-municipal corporations, school districts, and irrigation, reservoir, or drainage conservation companies or districts organized and existing under the laws of Colorado.2 “Foreign labor contractor” and “field labor contractor” have the definitions in C.R.S. §§ 8-4-101(7), (8.5).

2 The Rule 1.6 definition of employer parallels the statutory amendment to the “employer” definition enacted by Colorado H.B. 19-1267, effective January 1, 2020.

-

1.7 “Minor,” for purposes of wage provisions specific to minors, means a person under 18 years of age, but not one who has received a high school diploma or a passing score on the general educational development examination. “Emancipated minor” means any individual less than eighteen years of age who meets the definition provided by C.R.S. § 8-6-108.5.

-

1.8 “Regular rate of pay” means the hourly rate actually paid to employees for a standard, non- overtime workweek. Employers need not pay employees on an hourly basis. If pay is on a piece- rate, salary, commission, or other non-hourly basis, any overtime compensation is based on an hourly regular rate calculated from the employee’s pay.

-

1.8.1 Pay included in regular rate. The regular rate includes all compensation paid to an employee, including set hourly rates, shift differentials, minimum wage tip credits, non- discretionary bonuses, production bonuses, and commissions used for calculating hourly overtime rates for non-exempt employees. Business expenses, bona fide gifts, discretionary bonuses, employer investment contributions, vacation pay, holiday pay, sick leave, jury duty, or other pay for non-work hours may be excluded from regular rates.

-

1.8.2 Regular rate for employees paid a weekly salary or other non-hourly basis.

-

(A) A weekly salary or other non-hourly pay may be paid as straight time pay for all work hours, and the regular rate each workweek will be the total paid divided by hours worked, if the parties have a clear mutual understanding that the salary is:

-

(1) compensation (apart from any overtime premium) for all hours each workweek;

-

(2) at least the applicable minimum wage for all hours in workweeks with the greatest hours;

-

(3) supplemented by extra pay for all overtime hours (in addition to the salary that covers the regular rate) of an extra 1⁄2 of the regular rate; and

-

(4) paid for whatever hours the employee works in a workweek.

-

-

(B) Where the requirements of (1)-(4) are not carried out, there is not the required “clear mutual understanding” that the non-hourly pay provides the regular rate for all hours with extra pay added for overtime hours. Absent such an understanding, the hourly regular rate is the applicable weekly pay divided by 40, the number of hours presumed to be in a workweek for an employee paid no overtime premium.

-

-

-

1.9 “Time worked” means time during which an employee is performing labor or services for the benefit of an employer, including all time s/he is suffered or permitted to work, whether or not required to do so.

1.9.1 Requiring or permitting employees to be on the employer’s premises, on duty, or at a prescribed workplace (but not merely permitting an employee completely relieved from duty to arrive or remain on-premises) — including but not limited to, if such tasks take over one minute, putting on or removing required work clothes or gear (but not a uniform worn outside work as well), receiving or sharing work-related information, security or safety screening, remaining at the place of employment awaiting a decision on job assignment or when to begin w

ork, performing clean-up or other duties “off the clock,”

clocking or checking in or out, or waiting for any of the preceding — shall be considered time worked that must be compensated.

-

1.9.2 “Travel time” means time spent on travel for the benefit of an employer, excluding normal home to work travel, and shall be considered time worked. At the start or end of the workday, travel to or from a work station, entirely within the employer’s premises and/or with employer-provided transportation, shall not be considered time worked, except that such travel is compensable if it is:

-

(A) time worked under Rule 1.9 – 1.9.1;

-

(B) after compensable time starts or before compensable time ends under Rule 1.9 – 1.9.1; or

-

(C) travel in employer-mandated transportation (1) that materially prolongs commute time or (2) in which employees are subjected to heightened physical risk compared to an ordinary commute.

-

-

1.9.3 “Sleep time” means time an employee may sleep, which is compensable as follows. Where an employee’s shift is 24 hours or longer, up to 8 hours of sleeping time may be excluded from overtime compensation, if:

-

(A) an express agreement excluding sleeping time exists;

-

(B) adequate sleeping facilities for an uninterrupted night’s sleep are provided;

-

(C) at least 5 hours of sleep are possible during the scheduled sleep period; and

-

(D) interruptions to perform duties are considered time worked.

When an employee’s shift is less than 24 hours, periods when s/he is permitted to sleep are compensable work time, as long as s/he is on duty and must work when required. Only actual sleep time may be excluded, up to a maximum of 8 hours per workday. When work-related interruptions prevent 5 hours of sleep, the employee shall be compensated for the entire workday.

-

-

1.10 “Tipped employee” means any employee engaged in an occupation in which s/he customarily and regularly receives more than $30 per month in tips. Tips include amounts designated as a tip by credit card customers on their charge slips. Nothing in this rule prevents an employer from requiring employees to share or allocate such tips or gratuities on a pre-established basis among other employees who customarily and regularly receive tips. Employer-required sharing of tips with employees who do not customarily and regularly receive tips, such as management or food preparers, or deduction of credit card processing fees from tipped employees, shall nullify allowable tip credits towards the minimum wage.

-

1.11 “‘Wages’ or ‘compensation’” has the meaning provided by C.R.S. § 8-4-101(14).

-

1.12 “Workday” means any consecutive 24-hour period starting with the same hour each day and the same hour as the beginning of the workweek. The workday is set by the employer and may accommodate flexible shift scheduling.

-

1.13 “Workweek” means any consecutive set period of 168 hours (7 days) starting with the same calendar day and hour each week.

Rule 2. Coverage and Exemptions.

2.1 Scope of coverage. The COMPS Order regulates wages, hours, working conditions, and procedures for all employers and employees for work performed within Colorado, with the exceptions and exemptions contained within Rule 2.

2.2 Exemption from all except Rules 1, 2, and 8. The following are exempt from the COMPS Order except Rules 1 (Authority and Definitions), 2 (Coverage and Exemptions), and 8 (Administration and Interpretation).

-

2.2.1 Administrative employees. This exemption covers a salaried employee, paid at least the applicable salary in Rule 2.5, who directly serves the executive, and regularly performs duties important to the decision-making process of the executive. The employee must regularly exercise independent judgment and discretion in matters of significance, with a primary duty that is non-manual in nature and directly related to management policies or general business operations.

-

2.2.2 Executives or supervisors. This exemption covers a salaried employee, paid at least the applicable salary in Rule 2.5, who supervises the work of at least two full-time employees and has the authority to hire and fire, or to effectively recommend such action. The employee must spend a minimum of 50% of the workweek in duties directly related to supervision.

-

2.2.3 Professional employees. This exemption covers a salaried employee, paid at least the applicable salary in Rule 2.5, employed in a field of endeavor who has knowledge of an advanced type in a field of science or learning customarily acquired by a prolonged course of specialized intellectual instruction and study. The professional employee must be employed in the field in which s/he was trained.

-

2.2.4 Outside salespersons. This exemption covers an employee working primarily away from the employer’s place of business or enterprise for the purpose of making sales or obtaining orders or contracts for any commodities, articles, goods, real estate, wares, merchandise, or services. The employee must spend a minimum of 80% of the workweek in activities directly related to his or her own outside sales.

-

2.2.5 Owners or proprietors. This exemption covers a full-time employee actively engaged in management of the employer who either:

-

(A) owns at least a bona fide 20% equity interest in the employer; or

-

(B) for a non-profit employer, is the highest-ranked and highest-paid employee, and is paid at least the salary threshold in Rule 2.5.

-

-

2.2.6 Interstate transportation workers and taxi cab drivers. This exemption covers:

-

(A) an employee who is a driver, a driver’s helper, or a loader or mechanic of a motor carrier, if the employee crosses state lines in the course of his or her work; and

-

(B) taxi cab drivers employed by a taxi service provider licensed by a state or local government.

-

-

2.2.7 In-residence workers. This exemption covers the below-listed in-residence employees.

-

(A) Casual babysitters employed in private residences directly by households, or directly by family members of the individual(s) receiving care from the babysitter.

-

(B) Property managers residing on-premises at the property they manage.

-

(C) Student residence workers working in premises where they reside for sororities, fraternities, college clubs, or dormitories.

-

(D) Laundry workers who (a) are inmates, patients, or residents of charitable institutions, and (b) perform laundry services, (c) in institutions where they reside.

-

-

(E) Range workers in jobs related to herding or production of livestock on the range who occupy employer-provided housing as part of their employment and are provided without cost or deduction any housing, food, transport, and equipment required for H2-A visa range workers by federal regulations (20 C.F.R. §§ 655.210, 655.1304).

-

(F) Field staff of seasonal camps or seasonal outdoor education programs who primarily provide supervision or education of minors, or education of adults; are required to reside on-premises; are provided adequate lodging and all meals free of charge and without deduction from wages; and as of January 1, 2021, are paid the amount required by subpart (1) below (with no minimum pay required before January 1, 2021).

(1) Rule 2.2.7(F) exemption requires that field staff be paid either (a) the applicable Colorado minimum wage for all hours worked, or (b) a salary (i) equivalent to at least 42 hours per week at 90% of the Colorado minimum wage (with the 15% reduction that Rule 3.3 permits for unemancipated minors), (ii) reduced 25% for non-profit employers with annual total gross revenue of $25 million or less, and (iii) reduced $100 per week for lodging and meals, as illustrated below:

Type of Employee & Employer

Adult Minor

Non-Profit Employer, $25 Million or Less

$227.60 per week $152.00 per week

All Other Employers

$353.60 per week $278.00 per week

(2) “Seasonal” in Rule 2.2.7(F) means a camp or program that either (a) does not operate for more than seven months in a year, or (b) during the preceding calendar year had average receipts for any six months of not more than one-third (1⁄3) of its average receipts for the other six months.

-

2.2.8 Bona fide volunteers and work-study students. This exemption covers those who need not be compensated under the federal Fair Labor Standards Act (29 U.S.C. §§ 201 et seq.) as either: (A) enrolled students receiving credit for an unpaid work-study program or internship; or (B) bona fide volunteers for non-profit organizations.

-

2.2.9 Elected officials and their staff. This exemption covers individuals elected to public office and members of their staff.

-

2.2.10 Employees in highly technical computer-related occupations. This exemption covers an employee paid a salary, or hourly compensation, in accord with Rule 2.5, who:

-

(A) is a skilled worker employed as a computer systems analyst, computer programmer, software engineer, or other similarly highly technical computer employee;

-

(B) who has knowledge of an advanced type, customarily acquired by a prolonged course of specialized formal or informal study; and

-

(C) spends a minimum of 50% of the workweek in any combination of the following duties —

-

(1) the application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software, or system functional specifications,

(2) the design, development, documentation, analysis, creation, testing, or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications, or

(3) the design, documentation, testing, creation, or modification of computer programs related to machine operating systems.

2.3 Agriculture.

-

(2) the design, development, documentation, analysis, creation, testing, or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications, or

-

(3) the design, documentation, testing, creation, or modification of computer programs related to machine operating systems.

-

2.3.1 Workers in jobs in agriculture are exempt from Rule 3 (Minimum Wage), Rule 4 (Overtime), and Rule 5.1 (Meal Periods) if they are not covered by, or are exempt from, the minimum wage provisions of the federal Fair Labor Standards Act (29 U.S.C. §§ 201 et seq.). Other jobs in agriculture are exempt from Rule 4 (Overtime) and Rule 5.1 (Meal Periods). In workdays requiring multiple rest periods under Rule 5.2, rest periods need not total exactly 10 minutes in each 4-hour period, as long as an employee:

-

(A) receives rest periods that average, over the workday, at least 10 minutes per 4 hours worked; and

-

(B) receives at least 5 minutes of rest in every 4 hours worked.

-

-

2.3.2 The Rule 2.3.1 exemption does not apply if an employer draws at least 50% of its annual dollar volume of business from sales to the consuming public (rather than for resale) of any services, commodities, articles, goods, wares, or merchandise.3

3 Prior Orders for decades have covered any such employer, in any industry. E.g., Order #35, Rule 2(A) (covering any employer “that sells or offers for sale, any service, commodity, article, good, … wares, or merchandise to the consuming public” and draws “50% or more of its annual dollar volume … from such sales,” rather than from sales to other businesses “for resale.”)

-

2.3.3 “Jobs in agriculture” means jobs with work primarily within the same definition of “agriculture” as under 29 U.S.C. § 203(f) of the federal Fair Labor Standards Act: “farming in all its branches and among other things includes the cultivation and tillage of the soil, dairying, the production, cultivation, growing, and harvesting of any agricultural or horticultural commodities (including … agricultural commodities …), the raising of livestock, bees, fur-bearing animals, or poultry, and any practices (including any forestry or lumbering operations) performed by a farmer or on a farm as an incident to or in conjunction with such farming operations, including preparation for market, delivery to storage or to market or to carriers for transportation to market.” “Jobs in agriculture” also includes temporary employees employed directly by the Western Stock Show Association for the annual National Western Stock Show, who are exempt from all provisions of the COMPS Order.

2.4 Exemptions from Overtime Requirements of the COMPS Order. The following employees are exempt from Rule 4 (Overtime) unless otherwise specified.

-

2.4.1 Certain Salespersons and Mechanics. Salespersons, parts-persons, and mechanics employed by automobile, truck, or farm implement (retail) dealers; and salespersons employed by trailer, aircraft, and boat (retail) dealers are exempt from Rule 4 (Overtime).

-

2.4.2 Commission Sales. Sales employees of retail or service industries paid on a commission basis, provided that at least 50% of their total earnings in the pay period is derived from commission sales, and their regular rate of pay is at least one and one-half times the minimum wage, are exempt from Rule 4 (Overtime). This exemption is applicable for only employees of retail or service employers who receive over 75% of their annual dollar volume from retail or service sales.

-

2.4.3 Ski Industry. Employees of the ski industry performing duties directly related to ski area operations for downhill skiing or snowboarding, and those employees engaged in

providing food and beverage services at on-mountain locations, are exempt from (within Rule 4) the 40-hour overtime requirement but not the requirement of overtime pay for over 12 hours that are consecutive or are within a workday. This partial overtime exemption does not apply to ski area employees performing duties related to lodging.

-

2.4.4 Medical Transportation. Employees of the medical transportation industry who work 24- hour shifts are exempt from the Rule 4.1.1(B)-(C) daily (12-hour) overtime rules if they receive the required Rule 4.1.1(A) weekly (40-hour) overtime pay.

-

2.4.5 Eight and Eighty Rule. A hospital or nursing home may seek an agreement with individual employees to pay overtime pursuant to the provisions of the federal Fair Labor Standards Act “8 and 80 rule” whereby employees are paid time and one-half their regular rate of pay for any work performed in excess of 80 hours in a 14 consecutive day period and for any work in excess of 8 hours per day.

2.5 Salary Thresholds for Certain Exemptions.

2.5.1 For exemptions requiring a salary, the “Salary Requirement” rules of the federal Fair Labor Standards Act in 29 C.F.R. Part 541 Subpart G, apply, except that under the COMPS Order, the salary must be at least the level listed below and sufficient for the minimum wage for all hours in a workweek (with the exception of certain professionals listed in Rule 2.5.2). As detailed below: The weekly salary from July 1, 2020, through December 31, 2020, shall be $684 ($35,568 per year4), then shall be $778.85 for 2021, $865.38 for 2022, $961.54 for 2023, and $1,057.69 for 2024, and then shall be indexed every January 1 by the same Consumer Price Index (“CPI”) as the Colorado minimum wage; except that the 2020 salary does not apply to the following two categories of employers, to whom the below salary schedule applies only as of January 1, 2021 — (A) non-profit employers with annual total gross revenue of under $50 million, and (B) for- profit employers with annual total gross revenue of under $1 million.

4 Annual equivalents are based on 2080 hours over 52 weeks of 40 hours, as under the federal Fair Labor Standards Act, and are rounded to the nearest dollar.

Date July 1, 2020

January 1, 2021 January 1, 2022 January 1, 2023 January 1, 2024 January 1, 2025

Weekly Overtime-Exempt Salary (& Rounded Annual Equivalent) $684.00 per week ($35,568 per year)

$778.85 per week ($40,500 per year)

$865.38 per week ($45,000 per year)

$961.54 per week ($50,000 per year)

$1,057.69 per week ($55,000 per year)

The 2024 salary adjusted by the same CPI as the Colorado Minimum Wage

For any employer that is not subject to the $684 per week salary under this Rule 2.5.1 for all or part of 2020, the required salary is the equivalent of the Colorado $12.00 minimum wage, less any applicable lawful credits, for all hours worked in a workweek.5

5 This salary requirement of minimum wage for all hours work applied under Minimum Wage Order #35 (2019) and prior Minimum Wage Orders.

2.5.2 Exemption for Certain Professionals Exempt from the Salary Requirement under Federal Wage Law. The Rule 2.5.1 salaries do not apply to the following professionals who are exempt from the requirement of a salary under federal wage law.

(A) Doctors, lawyers, and teachers who qualify as exempt Rule 2.2.3 professional employees need not receive any particular salary or hourly pay to be exempt.

(B) Employees in highly technical computer-related occupations, as defined by Rule 2.2.10, must receive at least the lesser of (1) the applicable salary in Rule 2.5.1, or (2) hourly pay that is at least $27.63 in 2020, adjusted annually by CPI thereafter.

Rule 3. Minimum Wages.

-

3.1 Statewide Minimum Wage. Effective January 1, 2020, under the minimum wage requirements of Article XVIII, Section 15, of the Colorado Constitution, all employees (with the exceptions detailed in Rule 3.3), whether employed on an hourly, piecework, commission, time, task, or other basis, shall be paid not less than $12.00 per hour, less any applicable lawful credits or exceptions noted, for all hours worked, if the employee is covered by either:

-

(A) Rule 2 (Coverage and Exemptions) of the COMPS Order; or

-

(B) the minimum wage provisions of the federal Fair Labor Standards Act (29 U.S.C. §§ 201

et seq.).

-

-

3.2 Minimum and Overtime Wage Requirements of Other Applicable Jurisdictions. In addition to state wage requirements, federal or local laws or regulations may apply minimum, overtime, or other wage requirements to some or all Colorado employers and employees. If an employee is covered by multiple minimum or overtime wage requirements, the requirement providing a higher wage, or otherwise setting a higher standard, shall apply. The Division accepts state law complaints by employees who claim entitlement to a state, federal, or local minimum or overtime wages under the C.R.S. § 8-4-101(14) definition that the “unpaid wages” recoverable in a state-law claim include “[a]ll amounts for labor or service performed by employees,” as long as such amounts are “earned, vested, and determinable, at which time such amount shall be payable to the employee pursuant to this article.”

-

3.3 Reduced Minimum for Certain People with Disabilities and Minors. The minimum wage may be reduced by 15% for (a) non-emancipated minors and (b) persons certified by the Director to be less efficient in performance of their job duties due to a physical disability.

Rule 4. Overtime.

4.1 Overtime Wages.

-

4.1.1 Employees shall be paid time and one-half of the regular rate of pay for any work in excess of any of the following, except as provided below:

-

(A) 40 hours per workweek;

-

(B) 12 hours per workday; or

-

(C) 12 consecutive hours without regard to the start and end time of the workday.

-

-

4.1.2 Whichever of the three calculations in Rule 4.1.1 results in the greater payment of wages shall apply in any particular situation.

-

4.1.3 Hours worked in two or more workweeks shall not be averaged for computing overtime.

-

4.1.4 Performance of work in two or more positions, at different pay rates, for the same employer, shall be computed at the overtime rate based on the regular rate of pay for the position in which the overtime occurs, or at a weighted average of the rates for each position, as provided in the federal Fair Labor Standards Act.

-

4.1.5 In calculating when 12 consecutive hours are worked for purposes of the Rule 4.1.1 requirement of overtime after 12 hours, meal periods may be subtracted, but only if the meal periods comply with the Rule 5.1 requirements for meal periods.

-

4.2 Effect of Daily Overtime on Workday and Workweek. The requirement to pay overtime for work in excess of 12 consecutive hours will not alter the employee’s established workday or workweek, as previously defined.

-

4.3 Overtime for Minors. Nothing in Rule 4 modifies the provisions on work hours for minors contained in C.R.S. § 8-12-105.

Rule 5. Meal and Rest Periods.

-

5.1 Meal Periods. Employees shall be entitled to an uninterrupted and duty-free meal period of at least a 30-minute duration when the shift exceeds 5 consecutive hours. Such meal periods, to the extent practical, shall be at least one hour after the start, and one hour before the end, of the shift. Employees must be completely relieved of all duties and permitted to pursue personal activities for a period to qualify as non-work, uncompensated time. When the nature of the business activity or other circumstances make an uninterrupted meal period impractical, the employee shall be permitted to consume an on-duty meal while performing duties. Employees shall be permitted to fully consume a meal of choice on the job and be fully compensated for the on-duty meal period without any loss of time or compensation.

-

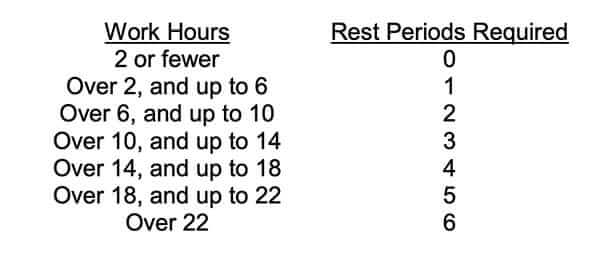

5.2 Rest Periods. Every employer shall authorize and permit a compensated 10-minute rest period for each 4 hours of work, or major fractions thereof, for all employees, as follows:

-

5.2.1 Rest periods shall be 10 minutes unless,

-

(A) on a given workday, or in a writing covering up to a one-year period that is signed by both parties, the employee and the employer agree, voluntarily and without coercion, to have two 5-minute breaks, as long as 5 minutes is sufficient, in the work setting, to allow the employee to go back and forth to a bathroom or other location where a bona fide break would be taken; or

-

(B) If the below conditions are met, rest periods need not be 10 minutes every 4 hours for any employees (i) governed by a collective bargaining agreement at any employer, or (ii) during time they are providing Medicaid-funded residential in-home services for an employer receiving at least 75% of its annual total gross revenue from federal and/or state Medicaid funds for providing such services. Employees in category (i) or (ii) must receive:

-

(1) rest periods that average, over the workday, at least 10 minutes per 4 hours worked; and

-

(2) at least 5 minutes of rest in every 4 hours worked.

-

Such an agreement does not change an employee’s right to pay for rest periods under Rule 5.2.4.

-

-

5.2.2 Rest periods, to the extent practical, shall be in the middle of each 4-hour work period. It is not necessary that the employee leave the premises for a rest period.

-

5.2.3 Required rest periods are time worked for the purposes of calculating minimum wage and overtime obligations.

5.2.4 When an employee is not authorized and permitted a required 10-minute rest period, his or her shift is effectively extended by 10 minutes without compensation. Because a rest period requires 10 minutes of pay without work being performed, work during a rest period is additional work for which additional pay is not provided. Therefore, a failure by an employer to authorize and permit a 10-minute compensated rest period is a failure to pay 10 minutes of wages at the employee’s agreed-upon or legally required (whichever is higher) rate of pay. This Rule 5.2.4 applies equally to rest periods that Rule 5.2.1 permits to be of different durations.

Rule 6. Deductions, Credits, and Charges.

-

6.1 Tips or Gratuities. It shall be unlawful for an employer to assert a claim to, right of ownership in, or control over tips or gratuities intended for employees in violation of the Colorado Wage Act, including C.R.S. § 8-4-103(6).

-

6.2 Credits Toward Minimum Wages. The only allowable credits an employer may take toward the minimum wage are those in Rules 6.2.1 – 6.2.3 below.

-

6.2.1 Lodging Credit. A lodging credit for housing furnished by the employer and used by the employee may be considered part of the minimum wage if it is:

-

(A) no greater than the smaller of (1) the reasonable and actual cost to the employer of providing the housing, (2) the fair market value of the housing, or (3) $25 per week for a room (in a shared residence, dormitory, or hotel) or $100 per week for a private residence (an apartment or a house);

-

(B) accepted voluntarily and without coercion, and primarily for the benefit

or convenience of the employee, rather than of the employer; and -

(C) recorded in a written agreement (electronic form is acceptable) that states the fact and amount of the credit (but need not be a lease).

-

-

6.2.2 Meal Credit. A meal credit, equal to the reasonable cost or fair market value of meals provided to the employee, may be used as part of the minimum hourly wage. No profits to the employer may be included in the reasonable cost or fair market value of such meals furnished. Employee acceptance of a meal must be voluntary and uncoerced.

-

6.2.3 Tip Credit. A tip credit no greater than $3.02 per hour may be used to offset cash wages for employers of tipped employees. An employer must pay a cash wage of at least $8.98 per hour if it claims a tip credit against its minimum hourly wage obligation; if an employee’s tips combined with the cash wage of at least $8.98 per hour do not equal the minimum hourly wage, the employer must make up the difference in cash wages.

-

-

6.3 Uniforms.

-

6.3.1 Where wearing a particular uniform or special apparel is a condition of employment, the employer shall pay the cost of purchases, maintenance, and cleaning of the uniforms or special apparel, with the following exceptions:

-

(A) if the uniform furnished by the employer is plain and washable, and does not need or require special care such as ironing, dry cleaning, pressing, etc., the employer need not maintain or pay for cleaning; and

-

(B) clothing that is ordinary, plain, and washable that is prescribed as a uniform need not be furnished by the employer unless a special color, make, pattern, logo, or material is required.

-

-

6.3.2 The cost of ordinary wear and tear of a uniform or special apparel shall not be deducted from an employee’s wages.

-

Rule 7. Employer Record-Keeping and Posting Requirements.

-

7.1 Employee Records. Every employer shall keep at the place of employment, or at the employer’s principal place of business in Colorado, a true and accurate record for each employee which contains the following information:

-

(A) name, address, occupation, and date of hire of the employee;

-

(B) date of birth, if the employee is under 18 years of age;

-

(C) daily record of all hours worked;

-

(D) record of credits claimed and of tips; and

-

(E) regular rates of pay, gross wages earned, withholdings made, and net amounts paid each pay period.

-

-

7.2 Issuance of Earnings Statement. An itemized earnings statement of the information in Rule 7.1 shall be provided to each employee each pay period.

-

7.3 Maintenance of Earnings Statement Information. An employer shall retain records reflecting the information contained in an employee’s itemized earnings statement as described in this rule for at least 3 years after the wages or compensation were due, and for the duration of any pending wage claim pertaining to the employee.

-

7.4 Posting and Distribution Requirements.

7.4.1 Posting. Every employer subject to the COMPS Order must display a COMPS Order poster published by the Division in an area frequented by employees where it may be easily read during the workday. If the work site or other conditions make a physical posting impractical (including private residences employing only one worker, and certain entirely outdoor work sites lacking an indoor area), the employer shall provide a copy of the COMPS Order or poster to each employee within his or her first month of employment, and shall make it available to employees upon request. An employer that does not comply with the above requirements of this paragraph shall be ineligible for any employee-specific credits, deductions, or exemptions in the COMPS Order, but shall remain eligible for employer- or industry-wide exemptions, such as exempting an entire employer or industry from any overtime or meal/rest period requirements in Rules 4-5.

7.4.2 Distribution. Every employer publishing or distributing to employees any handbook, manual, or written or posted policies shall include a copy of the COMPS Order, or a COMPS Order poster published by the Division, with any such handbook, manual, or policies. Every employer that requires employees to sign any handbook, manual, or policy shall, at the same time or promptly thereafter, include a copy of the COMPS Order, or a COMPS Order poster published by the Division, and have the employee sign an acknowledgement of being provided the COMPS Order or the COMPS Order poster.

7.4.3 Translation. Employers with any employees with limited English language ability shall:

-

(A) use a Spanish-language version of the COMPS Order and poster published by the Division, if the employee(s) in question speak Spanish; or

-

(B) contact the Division to request that the Division, if possible, provide a version of the COMPS Order and poster in another language that any employee(s) need.

-

Rule 8 Administration and Interpretation.

8.1 Recovery of Wages.

-

(A) Availability of court action or Division administrative complaint. An employee receiving less than the full wages or other compensation owed is entitled to recover in a civil action the unpaid balance of the full amount owed, together with reasonable attorney fees and court costs, notwithstanding any agreement to work for a lesser wage, pursuant to C.R.S. §§ 8-4-121, 8-6-118. Alternatively, an employee may elect to pursue a complaint through the Division’s administrative procedure as described in the Colorado Wage Act, C.R.S. § 8-4-101, et seq.

-

(B) No minimum claim size. There is no minimum size of a wage claim, and thus no claim too minimal (“de minimis”) for recovery, because Article 4 requires paying “[a]ll wages or compensation” (C.R.S. § 8-4-103(1)(a)), and authorizes civil actions “to recover any amount of wages or compensation” (C.R.S. § 8-4-110(1)) and Division complaints “for any violation” (C.R.S. § 8-4-111(1)(a)).

-

8.2 Complaints. Any person may register with the Division a written complaint that alleges a violation of the COMPS Order within 2 years of the alleged violation(s), except that actions brought for a willful violation shall be commenced within 3 years.

-

8.3 Investigations. The Director or a designated agent shall investigate and take all proceedings necessary to enforce the payment of the minimum wage and other provisions of the COMPS Order, pursuant to these rules and C.R.S. Title 8, Articles 1, 4, and 6. Violations may be subject to the administrative procedure as described in the Colorado Wage Act, C.R.S. § 8-4-101, et seq.

-

8.4 Violations. It is theft under the Criminal Code (C.R.S. § 18-4-401) if an employer or agent:

-

(A) willfully refuses to pay wages or compensation, or falsely denies the amount of a wage claim, or the validity thereof, or that the same is due, with intent to secure for himself, herself, or another person any discount upon such indebtedness or any underpayment of such indebtedness or with intent to annoy, harass, oppress, hinder, coerce, delay, or defraud the person to whom such indebtedness is due (C.R.S. § 8-4-114); or

-

(B) intentionally pays or causes to be paid to any such employee a wage less than the minimum (C.R.S. § 8-6-116).

-

-

8.5 Reprisals. Employers shall not threaten, coerce, or discriminate against any person for the purpose of reprisal, interference, or obstruction as to any actual or anticipated investigation, hearing, complaint, or other process or proceeding relating to a wage claim, right, or rule. Violators may be subject to penalties under C.R.S. §§ 8-1-116, 8-4-120, and/or 8-6-115.

-

8.6 Division and Dual Jurisdiction. The Division shall have jurisdiction over all q

uestions arising with respect to the administration and interpretation of the COMPS Order. Whenever employers are subjected to Colorado law as well as federal and/or local law, the law providing greater protection or setting the higher standard shall apply. For information on federal law, contact the U.S. Department of Labor, Wage and Hour Division. -

8.7 Construction.

(A) Liberal construction of COMPS, narrow construction of exceptions/ exemptions. Under the C.R.S. § 8-6-102 “Construction” provision (“Whenever this article or any part thereof is interpreted by any court, it shall be liberally construed by such court.”), applicable to rules on “wages which are inadequate to supply the necessary cost of living” (§ 8-6-104), on “conditions of labor detrimental to [worker] health or morals” (§ 8-6-104), on “conditions of labor and hours of employment not detrimental to health or morals for workers” (§ 8-6-106), on “what are unreasonably long hours” (§ 8-6-106), on what requirements are “necessary to carry out the provisions of this article” (§ 8-6-108.5), and on minimum and overtime wages (§§ 8-6-109, -111, -116, -117): The provisions of the COMPS Order shall be liberally construed, with exceptions and exemptions accordingly narrowly construed.

-

(B) Subpart included in cross-references. Where any Division rule references another rule, the reference shall be deemed to include all subparts of the referenced rule.

-

(C) Minimum Wage Order references. References to the Colorado “Minimum Wage Order” shall be deemed to reference the COMPS Order, as the successor to the Colorado Minimum Wage Order.

8.8 Separability. The COMPS Order is intended to remain in effect to the maximum extent possible. If any part (including any section, sentence, clause, phrase, word, or number) is held invalid, (A) the remainder of the COMPS Order remains valid, and (B) if the provision is held not wholly invalid, but merely in need of narrowing, the provision should be retained in narrowed form.

Appendix A Statutory Authority.

-

C.R.S. §§ 8-1-101 (“‘General order’ means an order of the director applying generally throughout the state to all persons, employments, or places of employment under the jurisdiction of the division”);

-

8-1-103 (“[P]owers, duties, and functions of the director … , includ[e] … promulgation of rules, rates, regulations, and standards, and the rendering of findings, orders, and adjudications”);

-

8-1-107 (“[T]he director has the duty and the power to … [a]dopt reasonable and proper rules and regulations relative to the exercise of his powers and proper rules and regulations to govern the proceedings of the division and to regulate the manner of investigations and hearings.”)

-

8-1-108 (“[G]eneral orders shall be effective … after they are adopted by the director and posted”; “All orders of the division shall be … in force and prima facie reasonable and lawful until … found otherwise.”);

-

8-1-111 (“The director is vested with the power and jurisdiction to have such supervision of every employment and place of employment … [to] determine the conditions under which the employees labor … , to enforce all provisions of law relating thereto … to administer all provisions of this article with respect to the relations between employer and employee and to do all other acts and things convenient and necessary to accomplish the purposes of this article.”);

-

8-1-130 (“The director has full power to hear and determine all questions within his jurisdiction, and his findings, award, and order issued thereon shall be final agency action.”);

-

8-4-111 (“It is the duty of the director … to enforce generally the provisions of this article.”);

-

8-6-102 (“Whenever this article or any part thereof is interpreted by any court, it shall be liberally construed.”);

-

8-6-104 (“It is unlawful to employ workers in any occupation … for wages which are inadequate to supply the necessary cost of living and to maintain the health of the workers …. It is unlawful to employ workers in any occupation … under conditions of labor detrimental to their health or morals.”);

-

8-6-105 (“It is the duty of the director to inquire into the wages paid to employees and into the conditions of labor … in any occupation … if the director has reason to believe … conditions of labor are detrimental to the health or morals of said employees or that the wages paid to a substantial number of employees are inadequate to supply the necessary cost of living and tomaintain such employees in health.”);

-

8-6-106 (“The director shall determine the minimum wages sufficient for living wages … ; standards of conditions of labor and hours … not detrimental to health or morals for workers; and what are unreasonably long hours.”);

-

8-6-108 (“[F]or the purpose of investigating any of the matters [s/]he is authorized to investigate by this article … [t]he director has power to make reasonable and proper rules and procedure and to enforce said rules and procedure.””);

-

8-6-109 (“If after investigation the director is of the opinion that the conditions of employment surrounding said employees are detrimental to the health or morals or that a substantial number of workers in any occupation are receiving wages … inadequate to supply the necessary costs of living and to maintain the workers in health, the director shall proceed to establish minimum wage rates.”);

-

8-6-111 (“Overtime, at a rate of one and one-half times the regular rate of pay, may be permitted by the director under conditions and rules and for increased minimum wages which the director,

after investigation, determines and prescribes by order and which shall apply equally to all employers in such industry or occupation.”);

-

8-6-116 (“The minimum wages fixed by the director, as provided in this article, shall be the minimum wages paid to the employees, and the payment … of a wage less than the minimum … is unlawful”);

-

8-6-117 (“In every prosecution … of this article, the minimum wage established by the director shall be prima facie presumed to be reasonable and lawful and the wage required to be paid. The findings of fact made by the director acting within prescribed powers, in the absence of fraud, shall be conclusive.”);

-

8-12-115 (“The director shall enforce … this article” and “shall promulgate rules and regulations more specifically defining the occupations and types of equipment permitted or prohibited by this article.”); and

-

the Administrative Procedure Act, C.R.S. § 24-4-103.