Overtime Pay Exemptions Under Illinois Wage Laws

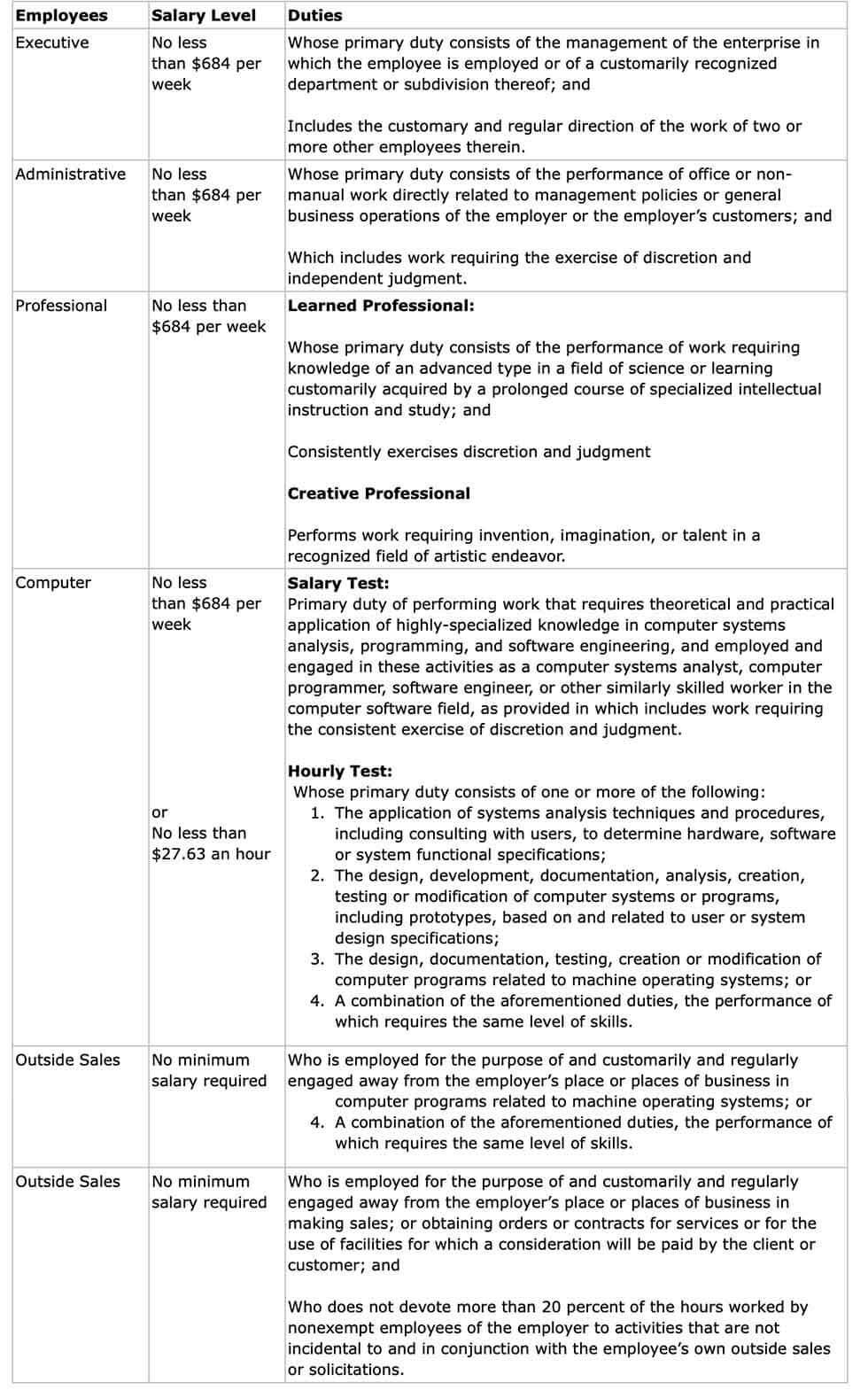

The following chart summarizes the various exemptions from overtime pay that are recognized by Illinois labor law, and includes information about the required minimum salary and the job duties necessary to qualify for the exemption. In order to be exempt, an employee must meet both the salary and job duties requirements. The Executive, Administrative and Professional exemptions are commonly referred to as the “white collar” exemptions from overtime pay.

See the Illinois State Labor Laws Page for additional information about Illinois overtime rules and wage laws.