If your employer did not provide a pay stub each time you got paid or provided one with little information, your employer was likely violating New York State law…and may owe you $5,000.

What Basic Information Is Required on All New York Pay Stubs?

The New York Wage Theft Prevention Act (WTPA) applies to employers in New York State and serves to protect employees hard-earned wages. With regard to information that must be given to workers on their pay stubs, the WTPA requires all pay stubs/wage statements to contain the following:

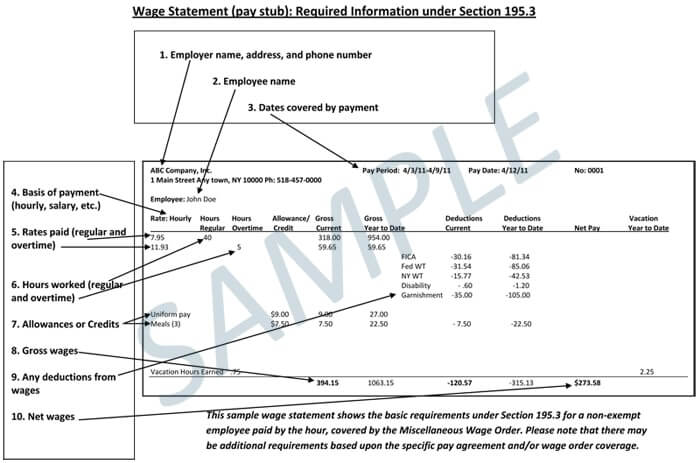

- Employer’s name, address, and phone number

- Employee name

- Dates covered by payment (pay period)

- Basis of payment (hourly, salary, commission, etc.)

- Rates paid (regular and overtime)

- Hours worked (regular and overtime)

- Allowances or credits applied against wages

- Gross wages

- Any deductions from wages, and

- Net wages

The New York Department of Labor has provided a sample pay stub (like the one below) that illustrates all of the basic information requirements.

Employees who do not receive proper pay stubs can be entitled to recover damages of up to $250 per violation, up to $5,000 per employee.

According to a New York Department of Labor opinion letter, providing electronic pay stubs will comply with the NY wage laws as long as the employer also provides either paper pay stubs or a workplace computer and printer that employees can use to view and print their pay stubs. In addition, the employer must allow employees to view and print their pay stubs without undue delay or effort and while on company time.

Pay Stub Requirements Under the New York Wage Theft Prevention Act

Many employees never realize they are not being paid their full/proper wages because they are not given a pay stub at all or are not given enough information on their pay stubs to understand how their pay is being calculated. New York state has done something about this problem, and it’s called the New York Wage Theft Prevention Act, or WTPA for short. Others just call it the New York Pay Stub Law. This provision of the NY Labor Law states that every employer shall provide each worker with a statement (pay stub) with every payment of wages, listing:

- Dates of work covered by the paycheck

- Name of the employee

- Name of the employer

- Employer’s address and phone number

- Employee’s rate or rates of pay and basis thereof (by hour, shift, day, week, salary, piece, commission, or other)

- Gross wages earned

- Deductions taken

- Allowances taken (tips, meal, lodging, etc.)

- Net wages earned

- Employee’s regular hourly rate or rates of pay, if the employee is not exempt

- Overtime rate or rates of pay, if the employee is not exempt

- Number of regular hours worked, if the employee is not exempt

- Number of overtime hours worked, if the employee is not exempt

- Applicable piece rate or rates of pay if the employee is paid by piece

- Number of pieces completed at each piece rate if the employee is paid by piece

- If the employer is a railroad corporation, the employee’s accrued total earning, taxes to date, and a listing of daily wages and how they were computed

The law also protects employees from retaliation for complaining about Labor Law violations and, to avoid violators from hiding behind a company, makes the 10 largest percentage owners of a Limited Liability Company jointly and severally liable for the wages owed to those employed by the LLC.

Which Industries Benefit the Most from This Law?

Very few states have labor laws that require this type of disclosure and transparency regarding wage payments, with New York and California leading the way and hopefully setting a trend.

The NY law applies to all types of businesses ranging from energy to construction and tech to transportation, but one particular industry targeted by the law is the restaurant business, which is notorious for all types of wage violations. Claims against restaurants include failing to properly identify the tip credit allowance taken. Some courts in New York have held that an employer is only allowed to apply the tip credit if the wage statements it provides to employees show the allowances claimed as part of the minimum wage. If not, the employer loses the right to take advantage of the tip credit for every workweek in which they did not comply with the pay stub law.

For more information and to find out if you may be owed up to $5,000 for pay stub violations plus back pay for any wage violations, contact our overtime pay lawyers who represent workers, not companies, in overtime pay claims. Call or submit your information using our convenient Case Evaluation form for a FREE and CONFIDENTIAL review of your circumstances.